Do you struggle with managing your finances and keeping track of your expenses? Do you wish you had a tool that could help you effortlessly manage your money and achieve your financial goals? Look no further than Mint – the personal finance app that’s taking the world by storm.

In this article, we’ll dive into the benefits of using Mint and how it can transform your financial life. From tracking your expenses to setting budgets, Mint has it all. Let’s get started!

What is Mint?

Before we dive into the benefits of Mint, let’s first discuss what it is. Mint is a personal finance app that helps you manage your money by tracking your expenses, creating budgets, and offering personalized financial advice. It’s a free app that’s available on both iOS and Android devices, making it accessible to everyone.

Benefit #1: Easy Expense Tracking

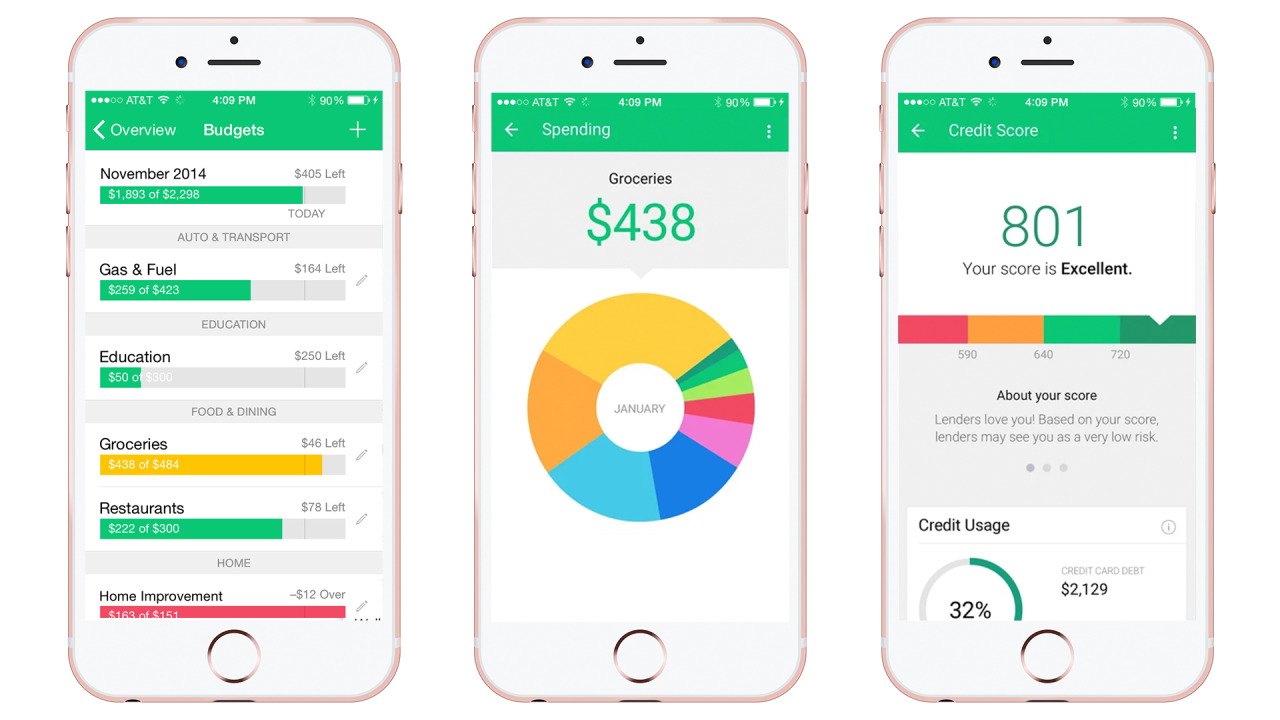

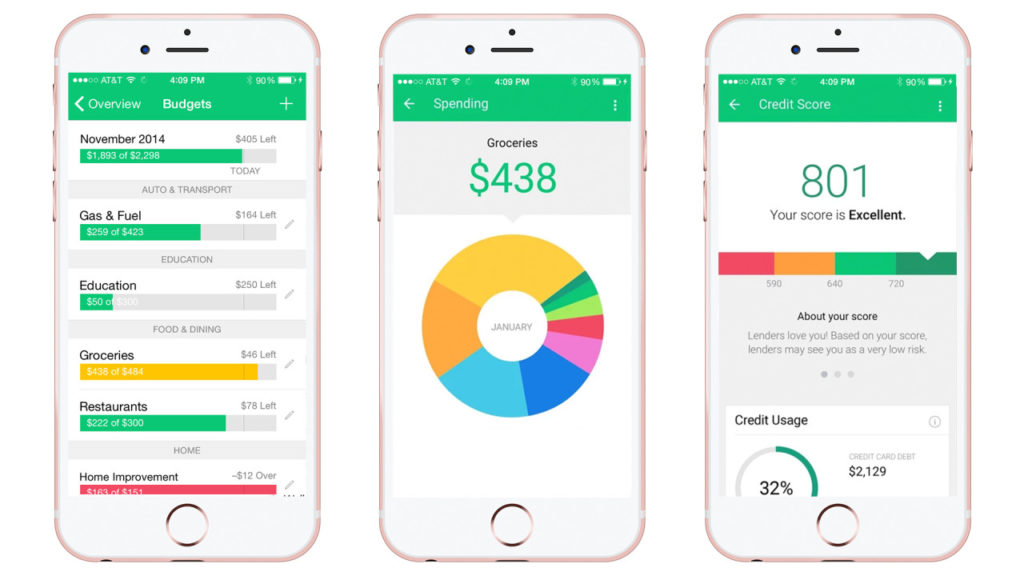

One of the biggest benefits of Mint is its ability to track your expenses effortlessly. Once you connect your bank accounts and credit cards to the app, Mint will automatically categorize your transactions and provide a clear overview of your spending habits. This makes it easy to see where your money is going and identify areas where you can cut back.

Benefit #2: Customized Budgeting

In addition to tracking your expenses, Mint also allows you to create customized budgets based on your unique financial goals. Whether you want to save for a down payment on a house or pay off your student loans, Mint can help you get there. The app will provide personalized budget recommendations based on your spending habits, making it easy to stay on track.

Benefit #3: Credit Score Monitoring

Your credit score is an essential part of your financial health, and Mint understands that. That’s why the app offers credit score monitoring, allowing you to keep track of your score and receive personalized tips on how to improve it. This feature is especially helpful if you’re planning to apply for a loan or credit card in the near future.

Benefit #4: Investment Tracking

If you’re an investor, Mint can help you keep track of your investments and monitor your portfolio’s performance. The app will provide personalized investment recommendations based on your risk tolerance and financial goals, making it easy to make informed investment decisions.

Benefit #5: Bill Payment Reminders

Are you tired of forgetting to pay your bills on time and incurring late fees? Mint has you covered. The app offers bill payment reminders, so you never have to worry about missing a payment again. You can even set up automatic payments for recurring bills, making your financial life even easier.

Benefit #6: Security and Privacy

We understand that security and privacy are major concerns when it comes to financial apps. That’s why Mint takes security seriously. The app uses multi-factor authentication, 256-bit encryption, and other security measures to keep your information safe and secure.

Benefit #7: Free and Easy to Use

Last but not least, one of the best things about Mint is that it’s completely free and easy to use. You don’t need to be a financial expert to use the app – it’s designed for everyone. Plus, it’s available on both iOS and Android devices, making it accessible to anyone with a smartphone.

Mint is a game-changing app that can transform your financial life. From easy expense tracking to personalized budgeting and investment tracking, Mint has it all. Plus, with features like credit score monitoring, bill payment reminders, and top-notch security, you can feel confident that your financial information is safe and secure. So why wait? Download Mint today and start taking control of your finances!

FAQs

- Is Mint really free?

- Yes, Mint is completely free to use. There are no hidden fees or charges.

- Is Mint secure?

- Yes, Mint takes security seriously and uses multi-factor authentication, 256-bit encryption, and other security measures to keep your information safe and secure.

- Can I trust Mint with my financial information?

- Yes, Mint is a trusted and reputable app used by millions of people worldwide. Plus, the app uses bank-level security measures to protect your information.

- How does Mint make money if it’s free?

- Mint makes money through partnerships with financial institutions and by offering personalized financial advice and recommendations to its users.

- Can I use Mint if I don’t live in the United States?

- Unfortunately, Mint is only available to users in the United States and Canada at this time.

Overall, Mint is an invaluable tool for anyone looking to take control of their finances and achieve their financial goals. With its easy expense tracking, customized budgeting, and personalized financial advice, Mint can help you save money, pay off debt, and invest for the future. Plus, with top-notch security measures and a user-friendly interface, you can feel confident that your financial information is in good hands. Download Mint today and start your journey to financial freedom!